What is RISE with SAP – And Why It Matters

For years, SAP has been the trusted backbone of enterprise operations, running mission-critical processes for companies like Unilever, Siemens, and Mercedes-Benz. But the way businesses consume technology is changing — and so is SAP.

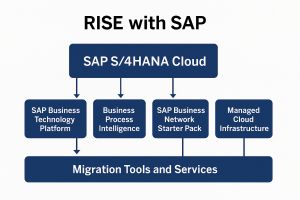

With RISE with SAP, the company is offering a new approach: a single, subscription-based package that bundles everything a business needs to migrate to the cloud, modernize operations, and become what SAP calls an “intelligent enterprise.”

From On-Premise to the Cloud — Without the Headaches

Traditionally, moving from SAP ECC (or any legacy ERP) to the next-generation S/4HANA required multiple vendors, separate infrastructure contracts, and a significant IT coordination effort. RISE with SAP simplifies this by combining:

SAP S/4HANA Cloud – the digital core, available in a private edition (for tailored migrations) or public edition (for standardized, fast deployments).

SAP Business Technology Platform (BTP) – credits for building custom apps, integrations, and AI-driven workflows.

Business Process Intelligence (powered by SAP Signavio) – tools that let businesses map their processes, find inefficiencies, and benchmark against industry best practices.

SAP Business Network Starter Pack – access to SAP’s procurement, logistics, and asset intelligence networks for better supplier collaboration.

Managed Cloud Infrastructure – hosted on hyperscalers like AWS, Microsoft Azure, or Google Cloud, with SAP managing the operations.

Migration Tools and Services – using SAP Activate methodology to guide businesses step by step.

In short, RISE with SAP removes much of the complexity of digital transformation by putting software, infrastructure, and services under a single contract — with SAP as the accountable partner.

Why Companies Are Signing On

Enterprises across industries are seeing the benefits. Microsoft migrated some of its internal finance systems to S/4HANA in the cloud. Coca-Cola İçecek, one of the world’s largest Coca-Cola bottlers, used RISE with SAP to streamline operations across 11 countries. Even smaller manufacturers are leveraging it to scale faster and access technologies like AI-driven demand forecasting and predictive maintenance.

The key benefits often cited include:

Simplification – no more managing multiple vendors or data center operations.

Speed & Innovation – regular updates and faster access to features like embedded analytics, machine learning, and automation.

Agility – the ability to pivot operations quickly, whether scaling production or entering new markets.

Cost Predictability – moving from capital-heavy IT investments to a predictable subscription model.

Data-Driven Process Optimization – using Signavio insights to redesign processes for efficiency.

The Bigger Picture

RISE with SAP is more than a product bundle — it’s SAP’s strategy to keep its vast customer base engaged as the software world shifts to the cloud. Competitors like Oracle NetSuite, Infor, and Microsoft Dynamics 365 are chasing the same enterprise customers with cloud-first solutions.

By offering RISE, SAP positions itself not just as a software vendor but as a transformation partner. For companies facing pressure to modernize quickly — whether due to supply chain disruption, rising costs, or global competition — RISE provides a curated, lower-risk path to get there.

The SAP S/4HANA migration market is one of the fastest-growing segments in enterprise software today. With the 2027 deadline for SAP ECC’s mainstream maintenance looming, companies across industries are racing to modernize their ERP systems. This rush is fueling not only a massive technology shift but also an unprecedented demand for skilled SAP consultants, cloud migration experts, and ERP project managers.

Market Size and Growth

The numbers behind the S/4HANA market are striking. Analysts estimate the 2024 market size for SAP S/4HANA applications at $5.2 billion to $26.3 billion, depending on whether you include surrounding services such as implementation, training, and managed support.

Looking ahead, the market shows no signs of slowing down:

$16 billion by 2033 – projected value for the core S/4HANA application market.

$60+ billion by 2030 – when including SAP HANA and the full ecosystem of partners, services, and integrations.

This growth is not just about software licenses — it’s about a full-scale transformation of enterprise operations worldwide.

The Migration Wave

At the heart of this market boom is the mass migration of roughly 30,000 SAP ECC customers who must convert to S/4HANA before 2027. This migration wave represents one of the largest coordinated IT shifts in history, creating a surge in:

Implementation projects – large-scale rollouts of new ERP systems.

Consulting opportunities – guiding enterprises through process redesign and change management.

Cloud adoption – many organizations are using this transition to move to SAP S/4HANA Cloud or hyperscaler platforms like AWS, Azure, and Google Cloud.

Adoption Trends & Real-World Examples

As of mid-2025, 28,000+ companies are running S/4HANA — and the list includes some of the biggest names in global business:

Walmart – modernizing finance and supply chain management with S/4HANA.

Amazon – leveraging S/4HANA for global inventory and logistics optimization.

Apple – streamlining manufacturing operations and financial consolidation.

Siemens, Nestlé, Unilever – investing in long-term ERP transformation roadmaps.

Even with these headline-grabbing projects, only 37% of SAP customers worldwide had purchased S/4HANA licenses by 2024, meaning most migrations are still ahead. Adoption is highest in IT & Services (22%) and Software (6%), with the U.S., India, and Germany leading the charge geographically.

Competitive Landscape

SAP S/4HANA commands about 10.19% of the global ERP market, putting it in fierce competition with Microsoft Dynamics 365, Workday, and Oracle NetSuite. Beyond the core software, a vast $89+ billion services market has emerged for S/4HANA implementations, upgrades, and ongoing support. Key players — including Deloitte, Capgemini, Accenture, and SAP’s own consulting arm — are scaling their teams and hiring aggressively to meet surging client demand.

Bottom Line

The S/4HANA migration market in 2025 is not just large — it’s accelerating. With less than two years left before ECC support ends, thousands of enterprises still need to migrate. For SAP customers, this is a crucial moment to lock in roadmaps and resources. For technology professionals, integrators, and consultants, the opportunity is enormous — offering years of project work and career growth in one of the most significant enterprise IT transitions of the decade.

As of early September 2025, SAP has doubled down on artificial intelligence, sovereign cloud services, and high-profile acquisitions in an effort to strengthen its position as a global enterprise software leader. The company’s latest announcements highlight its ambition to combine innovation with digital sovereignty, while addressing ongoing customer concerns about cloud migration.

Driving AI Innovation

SAP’s generative AI copilot, Joule, is expanding rapidly across its business application portfolio. The newest updates introduce AI agents for supply chain, finance, and procurement, while also embedding Joule into Microsoft Teams and Microsoft 365 Copilot. These integrations aim to streamline workflows and enhance everyday productivity for users.

For developers, SAP is enhancing its Business Technology Platform (BTP) with AI-assisted tools. Additions to SAP Build and SAP HANA Cloud are designed to simplify the creation of custom AI applications and strengthen data integration, giving development teams more flexibility and speed.

Reinforcing Cloud and Data Sovereignty

A central theme of SAP’s strategy is sovereign cloud expansion in Europe. The company announced an investment of over €20 billion to boost digital independence and foster AI innovation in the region.

SAP also unveiled a new “Sovereign Cloud On-Site” service, enabling customers to run cloud workloads directly in their own data centers. Managed by SAP-certified staff, this offering promises greater control, compliance, and data sovereignty.

At the same time, SAP continues to push its S/4HANA Cloud migration agenda. While customers have been given more time to transition from on-premise solutions, challenges around costs, complexity, and readiness persist.

Expanding Through Acquisitions and Partnerships

In August, SAP confirmed plans to acquire SmartRecruiters, an AI-driven talent acquisition platform. The move will strengthen SAP SuccessFactors HCM by enhancing recruiting and hiring capabilities.

SAP is also entering the fast lane with a partnership with the Mercedes-AMG PETRONAS Formula 1 team, which will leverage SAP’s Cloud ERP to improve performance and data-driven decision-making.

Other recent collaborations include:

Alibaba – hosting SAP cloud workloads in China

AWS and NVIDIA – joint initiatives to accelerate enterprise AI adoption

Other Key Developments

Maintenance Fee Adjustments: Beginning January 1, 2026, SAP will link support contract fees to the Consumer Price Index (CPI), with a maximum annual increase of 5%.

Security Updates: In August, SAP released patches for several critical vulnerabilities, including high-severity issues affecting its Graphical User Interface (GUI).

Customer Sentiment: Despite SAP’s AI and cloud-first vision, many customers remain cautious. Concerns center on pricing transparency, migration difficulties with RISE, and reduced focus on on-premise solutions.